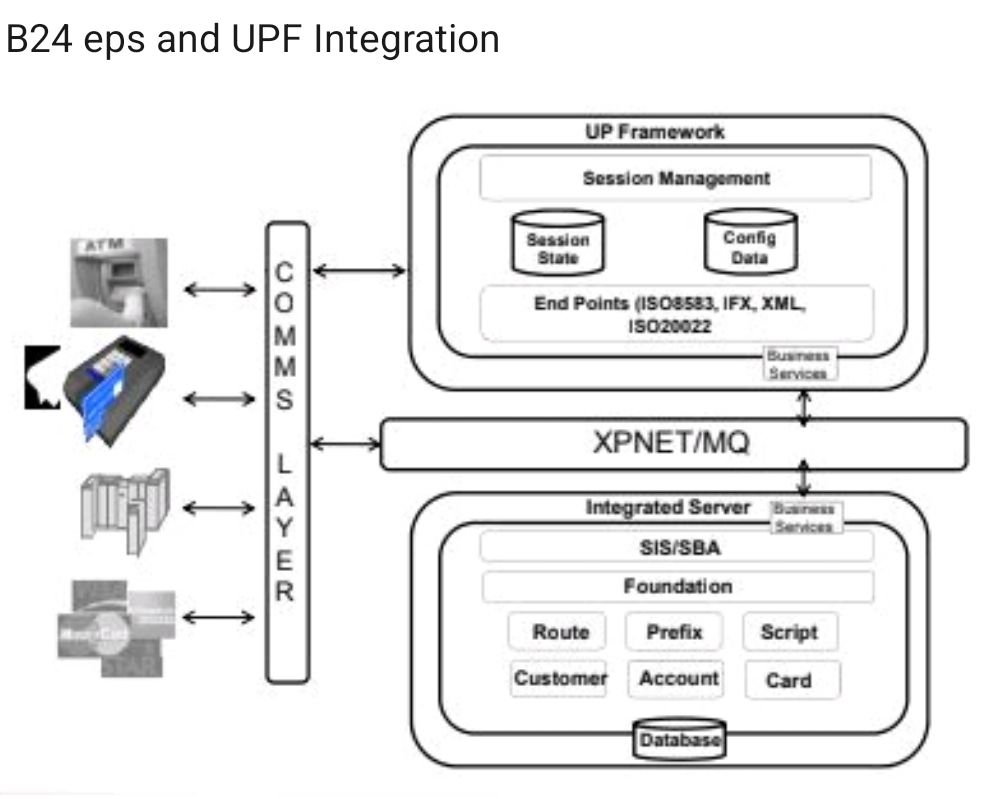

Integration between BASE24-eps and the Universal Payments Framework (UPF) is a core part of ACI Worldwide’s strategy to bridge legacy payment systems with modern, real-time payment capabilities. The UP Framework acts as a bridge, allowing financial institutions to orchestrate diverse payment types and channels while protecting their existing investment in BASE24-eps infrastructure.

Key Aspects of the Integration

- Investment Protection: The UP Framework allows existing BASE24 customers to continue using their current systems for some functions while incrementally adding new payment types and volumes through the UP Framework. This approach eliminates the need for a complete “rip and replace” of legacy systems.

- Modernization and Flexibility: The integration with UPF allows banks to rapidly introduce new payment methods, adhere to new network schemes (like real-time payments), and integrate with new partners through configuration rather than custom coding.

- Unified Retail Payments: UP Retail Payments is ACI’s comprehensive solution that combines the strengths of BASE24-eps (a market-leading retail payment platform) and the UP Framework (which orchestrates all aspects of payments processing) into a single, end-to-end platform.

- Data Protection & Compliance: The UPF is used in conjunction with data security solutions (like Comforte’s SecurDPS) to tokenize sensitive cardholder data before it is passed to BASE24-eps applications or stored in logs, helping institutions meet PCI DSS compliance requirements.

- Role-Based Expertise: The integration is an area of specialized technical expertise in the payment industry, with job roles focusing on the implementation, customization, configuration, and support of both BASE24-eps and UPF modules.

In essence, the UPF provides a flexible, open architecture that extends the life and capabilities of BASE24-eps, enabling financial institutions to manage traditional and emerging payment demands within a unified ecosystem.

What is BASE24-eps?

BASE24-eps is a comprehensive solution for acquiring, authenticating, routing, switching, and authorizing card- and non-card-based financial transactions through various channels.

BASE24-eps is designed to:

- Increase the profitability of payment processing by enabling a set of common transaction services to support multiple channels and different types of transactions

- Offer organizations greater flexibility with built-in support for all major card types, devices, national and regional switches, international payment schemes and host systems

- Create a comprehensive view of customers and ensure consistent, high-quality customer service across different points of contact

- Reduce organizations’ total cost of ownership through complete platform independence

- Give organizations the options to deploy on premise, in their own private or public cloud, or in a secure, cloud-based environment managed by ACI